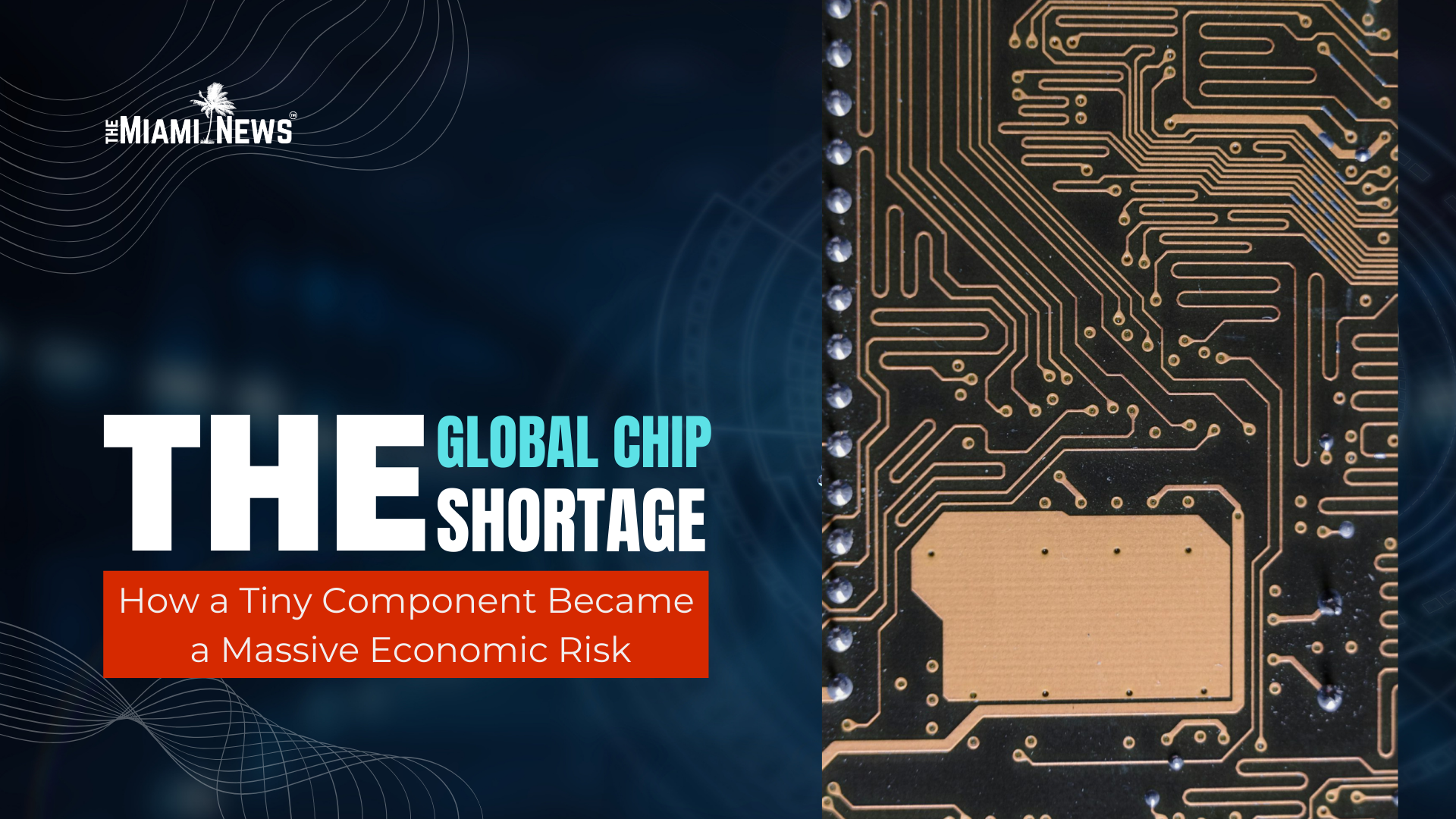

In 2025, global supply chains are still grappling with a crisis most consumers cannot see, but everyone feels. The microchip, a component no larger than a fingernail, continues to throttle entire industries, from carmakers to AI startups. The global chip shortage, which began during the COVID-19 pandemic, has evolved into a persistent supply bottleneck with far-reaching economic consequences.

Demand Surges, Supply Lags

Semiconductors power nearly every modern product, from smartphones and laptops to electric vehicles and industrial machinery. As AI adoption surged in 2024, so did the need for high-performance chips. According to the Semiconductor Industry Association, global chip demand is projected to grow by 20 percent annually through 2028.

Yet manufacturing has not kept pace. Chip fabrication requires highly specialized facilities, known as fabs, which take years to build and cost billions of dollars. Geopolitical tensions in East Asia, where the majority of chips are made, have further disrupted output.

Consumers Are Feeling the Squeeze

Shortages are no longer limited to high-end tech. In 2025, everyday goods are affected. Prices for laptops, gaming consoles, and even refrigerators have risen due to supply constraints. Automakers like Ford and Toyota have scaled back production, causing wait times for new vehicles to stretch into months.

“I ordered a phone last December and got it in April,” says Angela Ramirez, a Miami-based college student. “Everything’s more expensive, and everything takes longer.”

Retailers are adapting by stocking fewer electronics and pushing longer warranty periods. Meanwhile, consumers are holding onto older devices longer, contributing to a slowdown in global hardware sales.

How Governments and Firms Are Responding

The U.S., EU and Japan have all launched chip subsidy programs to boost local production. The CHIPS and Science Act in the U.S. has led to new fab construction in states like Arizona and Texas. However, experts warn that these solutions are years away from easing the current strain.

Private companies are also adjusting. Nvidia, AMD and Apple have started redesigning chips to rely less on the most congested manufacturing nodes. Supply chain diversification is a long-term strategy, but critics say it still leaves much of the world dependent on a few key players, particularly TSMC in Taiwan and Samsung in South Korea.

A Warning Sign for Future Innovation

Beyond immediate delays and price hikes, the chip shortage reveals a deeper vulnerability. As industries become more digitized and AI-reliant, the global economy is increasingly dependent on a tiny number of manufacturers producing an essential resource.

“The chip shortage is not just a tech problem. It’s a systemic risk,” says Dr. Lena Chao, a supply chain analyst at the University of London. “We need to treat semiconductors like we treat oil, food or medicine as strategic resources.”

What to Watch in 2026

While demand remains high, analysts expect modest relief in late 2025 as new production lines come online. Still, climate change, geopolitical conflicts, and the complexity of chip manufacturing mean the issue is unlikely to vanish quickly.

For consumers and companies alike, planning for a less predictable supply of semiconductors is now part of everyday life. The crisis may have started with smartphones and gaming consoles, but it has revealed just how dependent the modern world has become on these microscopic machines.

Be First to Comment